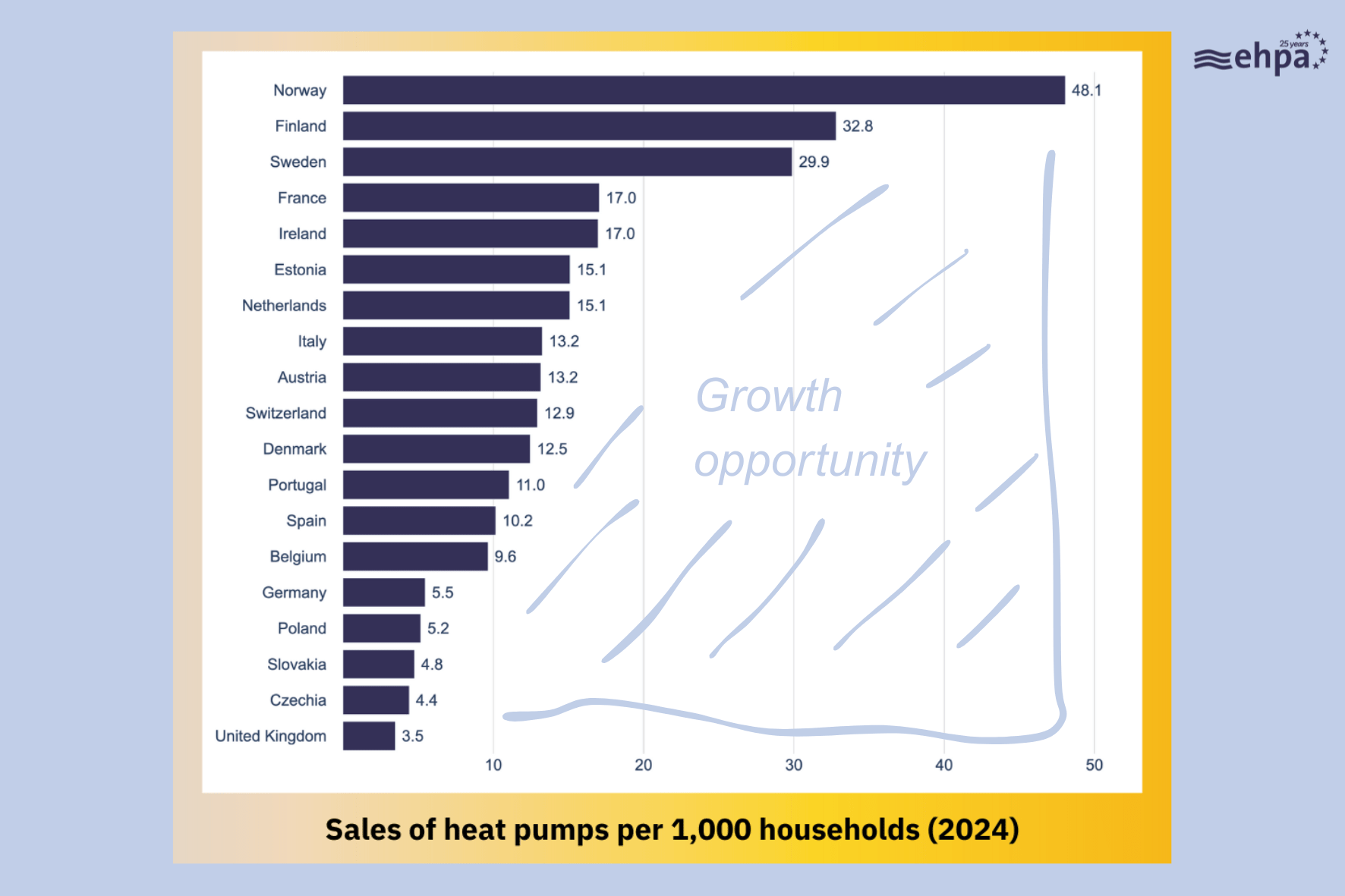

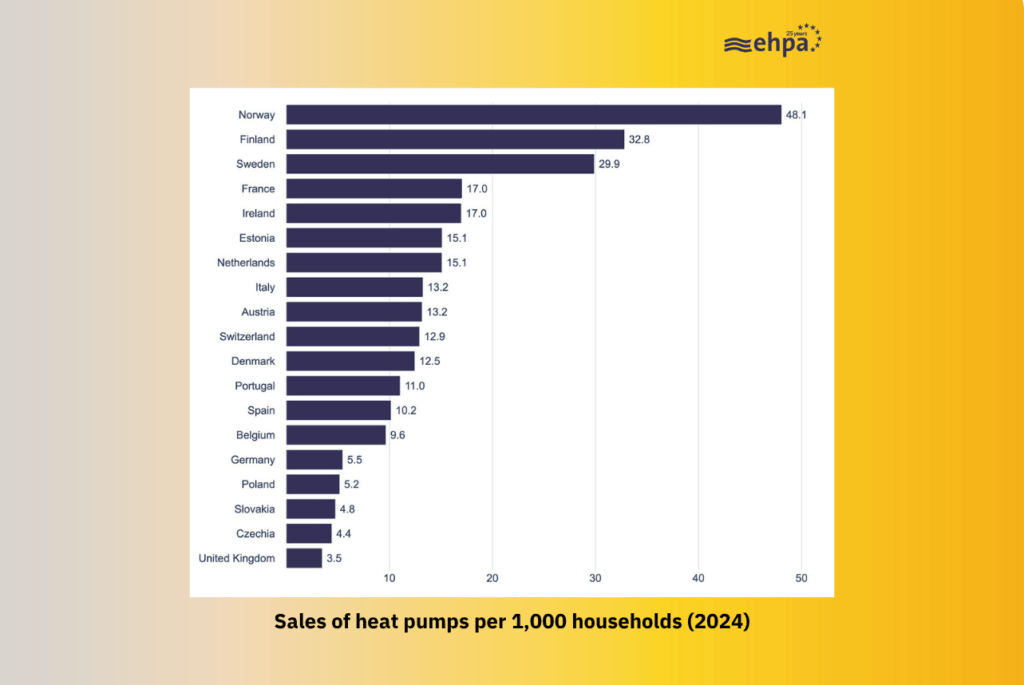

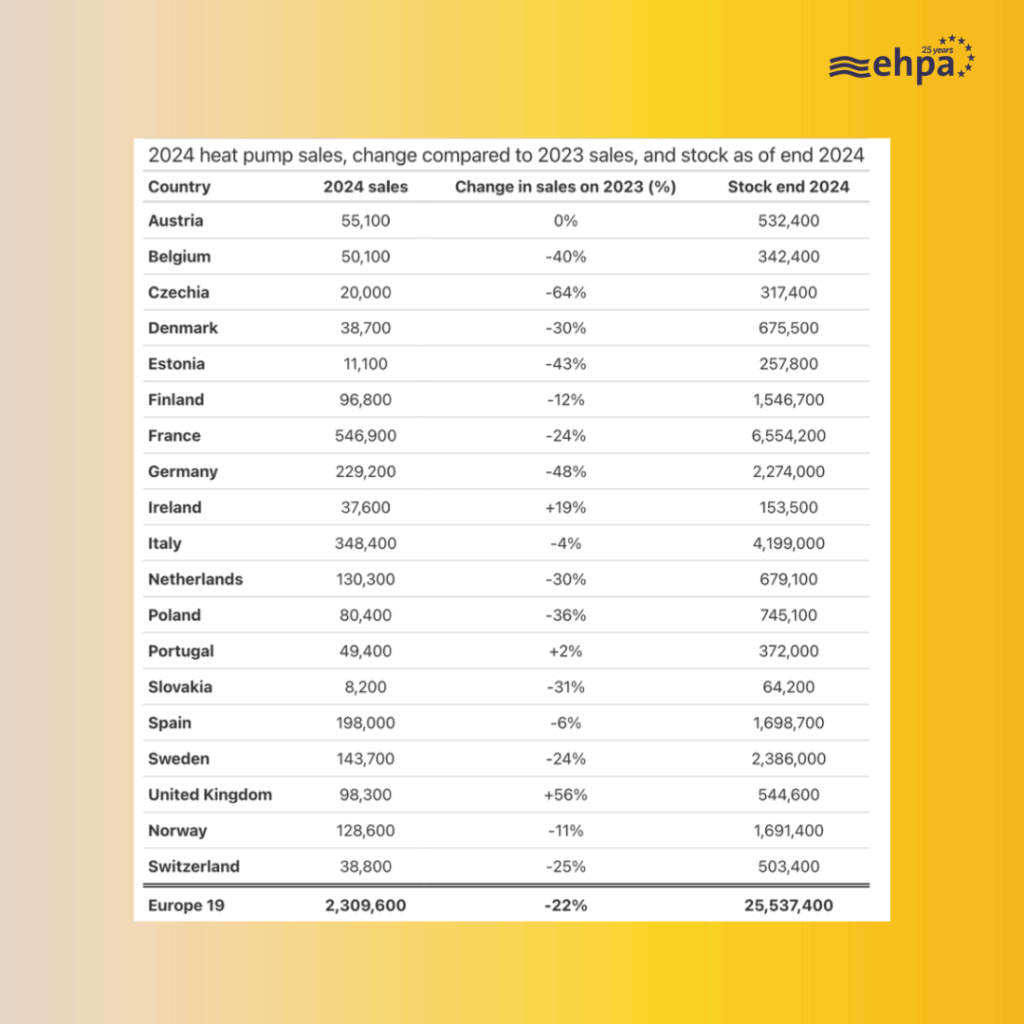

In 2024, heat pump sales dropped by 22% in 19 European countries. Yet, two nations in particular bucked the trend – the UK and Ireland.

While starting from a low base – and still installing at far lower levels than many European countries – the UK’s upturn is worth examining more closely.

The country’s Boiler Upgrade Scheme offers households up to £7,500 (around € 8,600) to replace fossil fuel systems with heat pumps — a substantial incentive by European standards. Every unit installed must meet minimum efficiency standards, and hybrid systems (like gas boiler/heat pump combos) are excluded.

Second, clarity matters. While some European countries wavered on their heat pump policies, with shifting incentives or mixed signals, the UK has stayed the course in recent years. That kind of consistency matters — for consumers, for businesses, and for supply chains.

Of course, grants help. But this growth wasn’t only about subsidies. Public awareness also improved. And then there’s the workforce. One of the quieter but more impactful shifts in the UK was the effort to train more installers.

In 2024, the number of people completing heat pump training rose by 15%. That matters. Financial incentives don’t mean much if no one’s available to do the work. The UK didn’t solve the installer shortage, but it began to tackle it seriously.

Of course, there’s still a long way to go. Despite the growth, the UK’s per capita heat pump adoption remains among the lowest in Europe. Ambitious deployment targets lie ahead, and reaching them will require even greater investment, continued public support, and policy consistency.

It’s also worth mentioning Ireland, where sales have grown by 19% in 2024, thanks to long-term, stable policies. Ireland now ranks fifth in Europe for heat pump deployment per 1,000 homes. The transition began with the new-build market, which is now largely served by individual heat pumps — a shift driven by a clear policy commitment to move away from fossil fuels and toward indigenous, renewable electricity.

Ireland’s renovation market also shows strong potential, supported by generous grants linked to a rising carbon tax. But challenges remain, particularly in terms of customer experience — where complex and costly journeys risk slowing adoption. Authorities are now working to streamline these processes, while also ensuring installations are appropriately sized and buildings are properly prepared.

Still, Ireland is on track for continued growth, with 50,000 annual units likely in the near future — and potentially up to 100,000 by 2030 if government housing and retrofit targets are met.

So, what can other EU countries learn?

There’s no silver bullet, of course. Every country has its own challenges – different housing stock, climates, and political environments. But the examples of the UK and Ireland show that when policy, communication, and delivery align, progress is not only possible — it’s achievable, even in challenging conditions.

European governments may want to reflect on a few key questions. Could heat pump grants be simpler? Could policy signals be clearer and more consistent? Could public campaigns do more to address people’s practical concerns? Could more be done to grow the installer workforce?

The UK and Ireland’s recent success isn’t just a feel-good story; it’s a useful case study. Because if a country with historically sluggish heat pump adoption can grow 56% in a difficult year, the rest of Europe can, too.

See more on our new market intelligence public platform, and buy our market report (or become a member and get it for free!) for a truly in-depth dive on prices, sales, technologies, countries, building types and more.