The clean heat transition is no longer a question of if – it’s about how fast.

Since 2015, heat pumps have been steadily eating into the market share of traditional heating systems. And while 2024 was a tough year for overall sales, the technology’s grip on the market held firm.

Heat pumps claimed a solid 28% share of Europe’s space heating market last year. That’s just a few points below the 2023 peak of 31.6%, and still more than 6 percentage points higher than in 2021, when overall numbers of heat pumps sold were similar. In short, even in a cooling market, heat pumps are staying hot.

But zoom in, and the picture gets more nuanced.

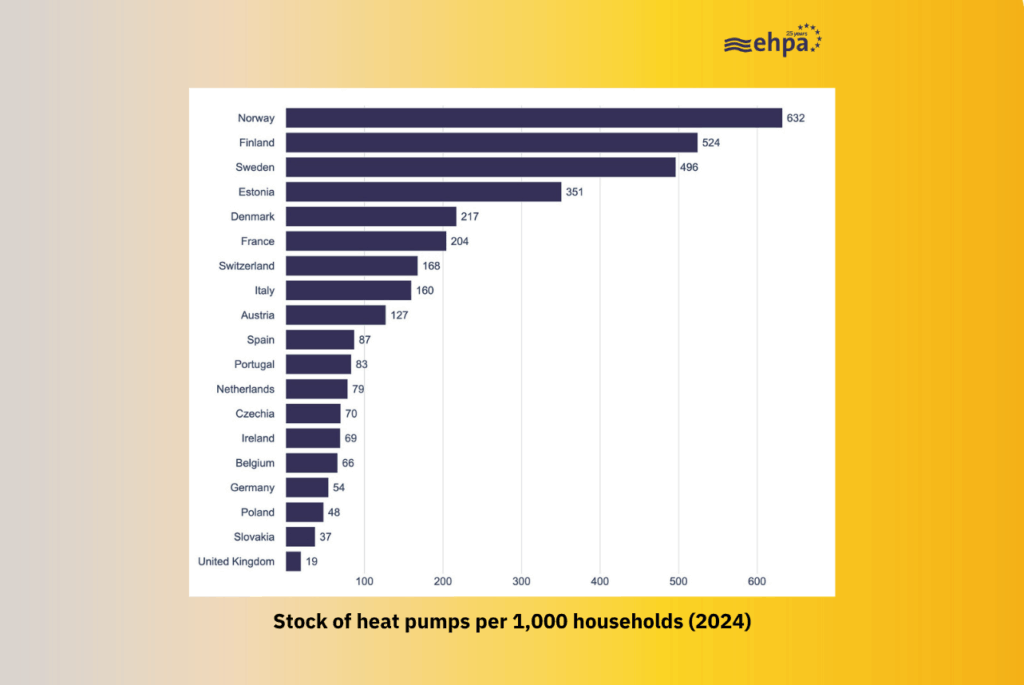

In terms of national markets, Norway, Sweden, and Finland continue to lead the chart with over 90% space heating market share for heat pumps in 2024. Norway keeps topping the table at 97%, showing what’s possible when policy, climate, and consumer demand align.

A second wave of countries – France, Austria, Switzerland, and Portugal – have also crossed the 40% threshold of annual space-heating unit sales, after starting below it just a few years ago. Switzerland’s climb is especially impressive, reaching 76%.

Meanwhile, large economies like Germany, Italy, the Netherlands, and the UK are moving from a lower starting point. Their market shares range between 5% and 30%, which continues to bring down the European average, but also shows that there is huge growth potential.

The takeaway? Every country in Europe has made real gains over the past decade. But with the right mix of policy, support, and communication, the pace of change can vary dramatically.

Market share is more than just a number – it’s a window into momentum.

To ensure momentum continues to grow for the heat pump sector – in line with EU climate and energy targets and to ensure European energy security and clean tech leadership – steady government support is key. This reassures manufacturers, investors and consumers that this is a sector for the future.

As well as this, making electricity competitive with gas – for example by shifting taxes off power bills – ensures a heat pump is a good investment for people’s wallets as well as for Europe’s economy and climate action.

See more on our new market intelligence public platform, and buy our market report (or become a member and get it for free!) for a truly in-depth dive on prices, sales, technologies, countries, building types and more.