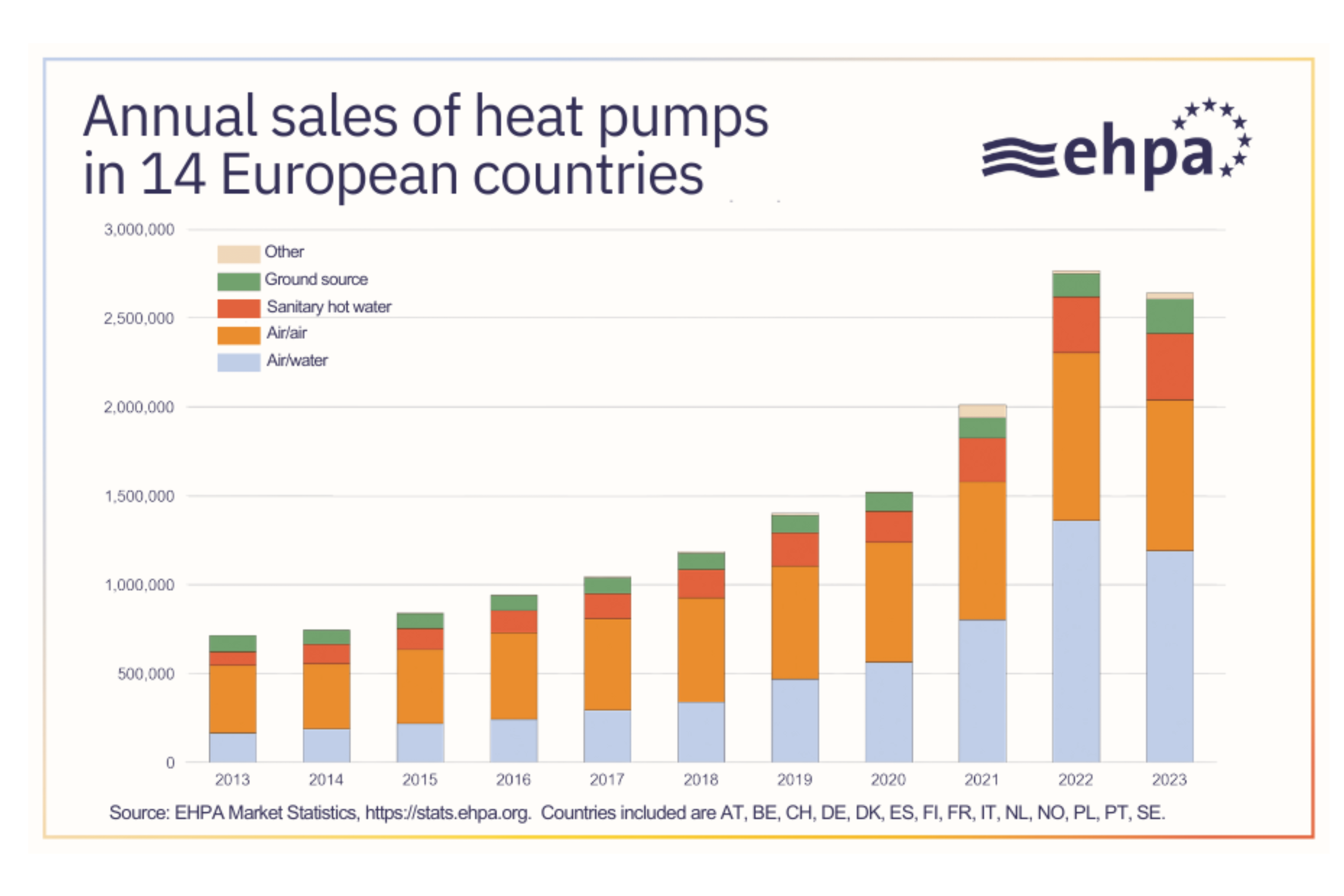

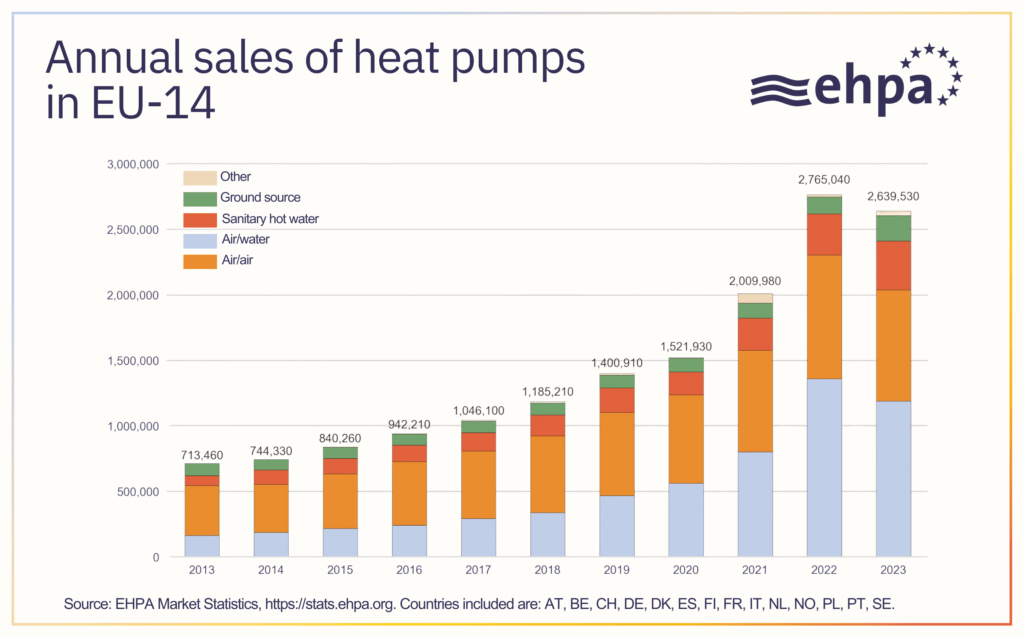

Market data

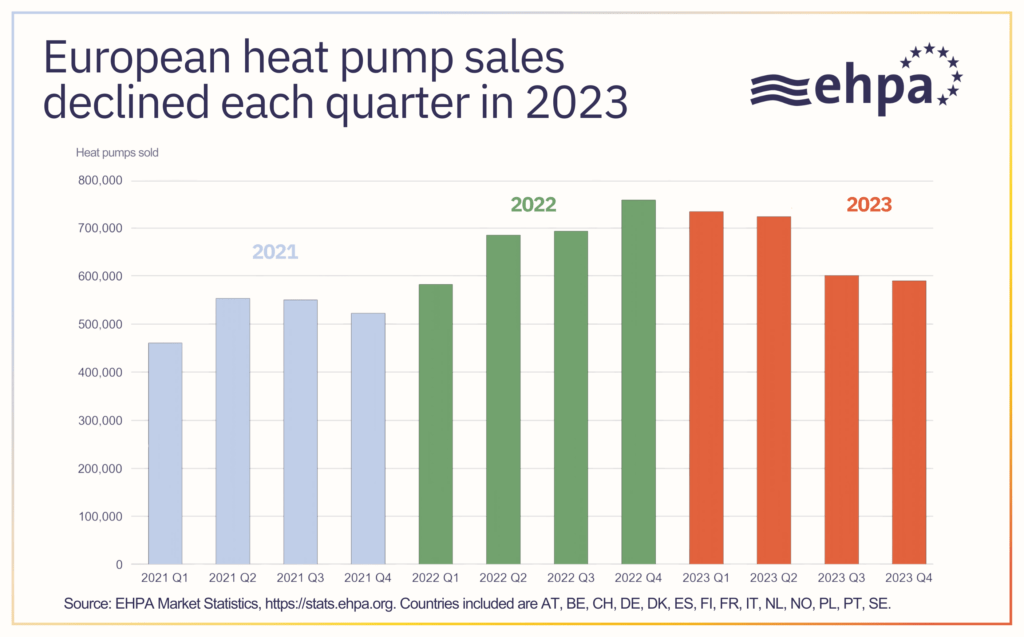

Heat pump sales in 14 European countries fell by around 5% overall in 2023 compared to 2022, reversing the trend of a decade. Sales dropped from 2.77 million to 2.64 million.

The slump comes as the EU postpones its Heat Pump Action Plan, which was meant to support the sector. Around 3,000 jobs are impacted so far.

EHPA is expecting total sales for 2023 to bring the total heat pump stock to around 23 million in Europe (EU 27 + UK, Norway and Switzerland), up from around 20 million at the end of 2022

Read the press release.

France, Italy, Sweden, Finland, Poland, Denmark, Austria and Switzerland all saw heat pump sales drop last year. While they increased in Portugal, Belgium, Norway, the Netherlands, Spain and Germany this was not enough to offset the overall decrease.

Even in countries that saw overall growth, quarterly sales declined towards the end of 2023.

The reasons for the slow-down in the heat pump market last year include high interest rates, expensive electricity compared to gas, and changing national policy measures. These are unsettling investors and consumers.

To ensure Europe’s heat pump sector continues to grow and meets the EU’s targets, EHPA is calling for the delayed EU Heat Pump Action Plan to be published rapidly. What’s more, the taxes and levies applied to energy should be addressed to reduce the price of electricity for end users.

EHPA publishes an in-depth look at the heat pump market in 21 European countries every year in its market report – see the contents page on the left.

See samples and information on how to access it (free to EHPA members and the media).

Read EHPA’s press release on the 2023 market data.

Explore EHPA’s online stats tool (members only) .

Read the 2023 market report, featuring information from 2022, and see the heat pump sales statistics online tool (EHPA members only)

or